Empower Your Finances With Debt Unions

With an emphasis on tailored services, competitive prices, and community assistance, credit scores unions supply a special technique to economic empowerment. The question continues to be: how can debt unions genuinely change your monetary expectation and provide a steady foundation for your future endeavors?

Advantages of Joining a Lending Institution

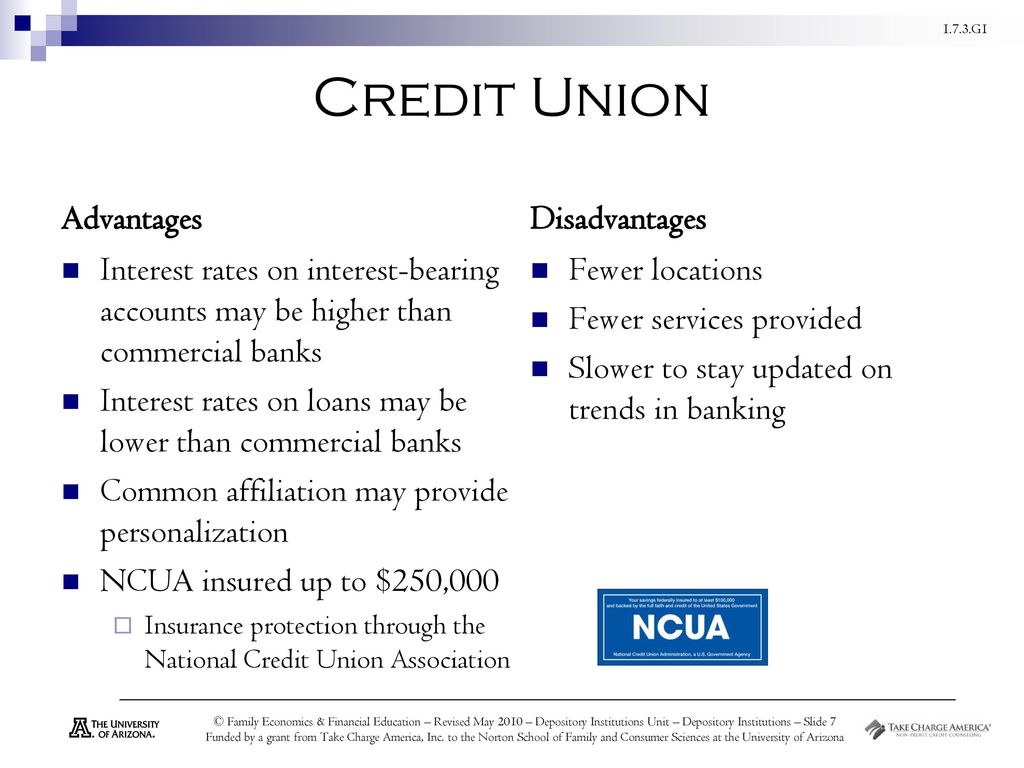

Joining a credit rating union uses various advantages that can boost your economic well-being. Among the key benefits is the possibility for higher rate of interest on interest-bearing accounts contrasted to typical financial institutions. Credit unions are member-owned, not-for-profit banks, permitting them to prioritize offering affordable rates to their members. In addition, lending institution commonly have reduced charges and financing rates, helping you save money over time.

Unlike huge financial institutions, credit rating unions frequently prioritize building partnerships with their members and understanding their distinct monetary requirements. Debt unions are recognized for their commitment to monetary education and empowerment, providing sources and workshops to help participants make educated choices regarding their cash.

Just How Cooperative Credit Union Offer Financial Education And Learning

Financial education is a cornerstone of lending institution' viewpoint, emphasizing the value of monetary proficiency in attaining long-lasting monetary health. Participants benefit from finding out just how to efficiently manage their money, plan for the future, and browse complicated economic systems. These instructional sources not just profit individual participants however additionally contribute to the total economic health and wellness of the community.

In addition, lending institution may partner with colleges, neighborhood companies, and regional organizations to increase their reach and effect. By collaborating with exterior stakeholders, cooperative credit union can further advertise economic education and encourage even more people to take control of their financial futures.

Accessibility to Affordable Financing Rates

To better boost the economic health of their participants, credit history unions supply accessibility to competitive car loan rates, allowing individuals to secure financing for various requirements at desirable terms. Credit Union Cheyenne. Unlike typical banks, credit unions are not-for-profit organizations that exist to offer their participants.

Lending institution commonly focus on the economic wellness of their participants over making best use of earnings. This member-centric method translates into supplying lendings with reduced interest rates, less charges, and much more flexible terms contrasted to many standard economic establishments. Additionally, cooperative credit union may be a lot more going to deal with people who have less-than-perfect credit report, providing them with possibilities to improve their monetary situations with responsible why not look here borrowing. Overall, the accessibility to affordable lending rates at cooperative credit union can significantly benefit members in attaining their financial goals.

Personalized Financial Advice

Participants of lending institution gain from customized financial suggestions and support, boosting their understanding of financial management methods. Unlike conventional banks, cooperative credit union focus on tailored solution, taking the time to evaluate each member's unique monetary circumstance and objectives. This customized method enables credit union participants to receive targeted referrals on how to enhance their financial well-being.

Enhancing Cost Savings Opportunities

With a concentrate on fostering financial development and stability, lending institution supply various opportunities for participants to boost their financial savings chances. Cooperative credit union provide affordable rate of interest rates on cost savings accounts, commonly more than typical financial institutions, enabling members to make much more on their deposits. Furthermore, numerous cooperative credit union provide special savings programs such as holiday savings accounts or young people interest-bearing accounts, urging members to save for particular objectives or teach young individuals about the relevance of saving.

Moreover, credit score unions may offer deposit slips (CDs) with competitive find out this here rates and terms, giving members with a secure means to conserve for the future while earning higher returns than typical financial savings accounts. Overall, cooperative credit union existing varied chances for participants to boost their cost savings and work in the direction of attaining their monetary objectives.

Final Thought

To conclude, lending institution provide numerous advantages such as greater passion prices on financial savings accounts, reduced fees, and individualized financial options. With access to competitive lending rates, tailored monetary assistance, and instructional programs, lending institution give a supportive environment to empower your funds and protect a brighter financial future. Joining a credit report union can assist you improve your savings chances and enhance your overall economic well-being.

Credit history unions often provide workshops, seminars, and on the internet resources covering different subjects such as budgeting, conserving, spending, and credit score management.Financial education and learning is a cornerstone of credit report unions' approach, stressing the importance of economic literacy in accomplishing lasting monetary health. In addition, debt unions might be extra eager to function with people who have less-than-perfect credit rating histories, offering them with possibilities to enhance their monetary scenarios with accountable borrowing (Wyoming Credit Unions).Members of credit scores unions profit from customized economic recommendations and advice, boosting their understanding of financial monitoring methods.Customized economic support from credit unions commonly consists of producing individualized budget strategies, establishing achievable economic objectives, and offering guidance on improving credit score scores